Trident Capital was established in 2001 and has a corporate advisory team with deep and broad experience in corporate, legal, financial and compliance transactions in a diverse range of industries including resources, technology, energy, wellness, bio medical, agri/aquaculture, industrial, telecommunication and financial services.

Approach

We offer the expertise and guidance to produce effective corporate structures to access the right capital that clients need in ever more complicated markets and have demonstrated an in-depth understanding of strategy and sector dynamics.

We have worked and cultivated long term relationships with our clients for nearly two decades to achieve their desired outcomes. We have achieved this by harnessing our experience and established relationships in the national and international regulatory and capital markets (both private and public) and a network of venture capital and private equity funds, institutions and high net worth individual offices globally.

CORPORATE ADVISORY

CAPITAL RAISING

MERGERS & ACQUISITIONS

Our Team

Trident Capital’s team draw from a wealth of experience to assist our clients in developing the right corporate strategies to achieve their desired transaction outcomes. Our advisory team are highly experienced in areas of corporate law, corporate finance, accounting, geology, both in Australia and international markets.

Recent Transactions

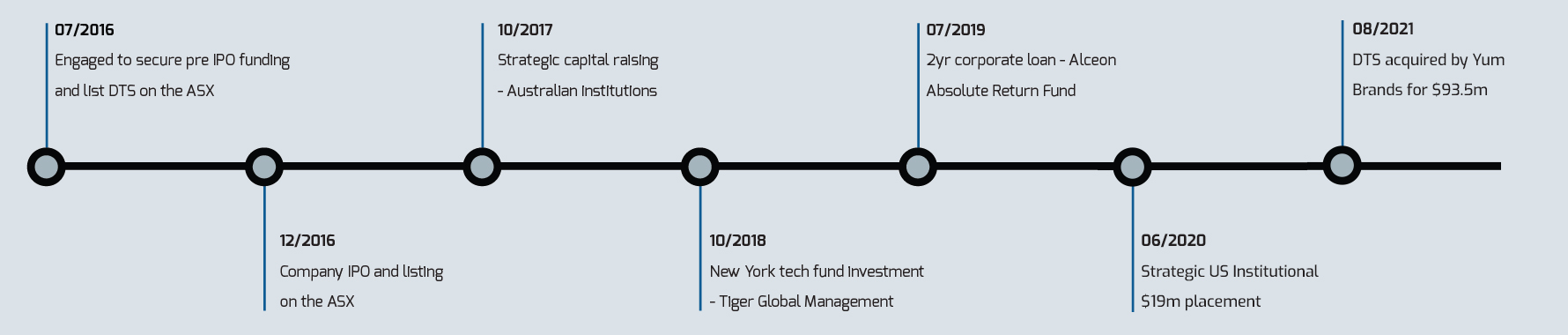

Dragontail Systems Ltd (ASX: DTS)

June 2020

Industry Software & Services

Transaction Various over 3 years and over $45m raised

Role Corporate Adviser facilitating ASX listing & development

Additional Trident Services

Company Secretarial services: 10/2016 – current / Accounting services: 11/2016 – current / Director services: 12/2016 – current

Get in Touch